Library Renovation Proposal

Renovation plans are on hold pending discussion by the Library Board at their regularly scheduled meetings.

History & Need

The current library building, located at 188 East Michigan Avenue, was constructed in 1990 on land donated by the City of Galesburg, with minimal upkeep having been done since its completion. Although it is a wonderful space in a great location, the functionality of the building has not kept pace with community needs. To remedy these concerns, the Library Board began working with the architectural firm C2AE and in early 2025 approved a renovation proposal.

The proposal includes a new Children’s Area, two small meeting/study rooms, a café, an updated circulation desk and new restroom facilities. Less “glamorous” improvements include adding storage, a utility room, and updating the electrical wiring.

When reviewing their options, the Board considered a “phased” plan for the renovations. However, following discussion with the architect and design specialist and analyzing cost projections, they determined that it would be more cost effective, and cause less disruption, to complete the project in one big push.

View architectural renderings of the proposed updates.

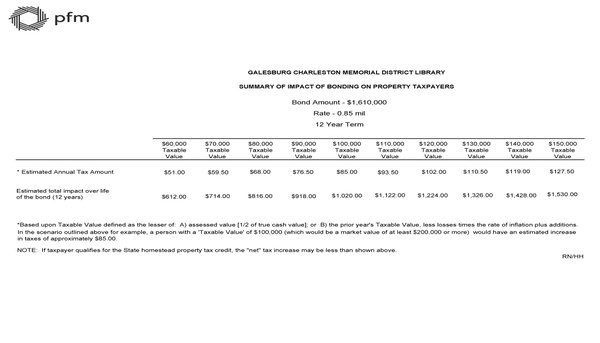

Property Tax Impact Calculator (August 2025 proposal)

Bond Proposal (August 2025)

With the renovation planned, the Board next had to decide how to pay for it. The library’s current operating millage is just that, funds used for day-to-day operations: staff salaries, utilities, material purchases (and the supplies needed to process them), and programs for children, teens and adults. Since becoming a district library in 2014, our expenses have never exceeded our budget. In fact, we are proud of the fact that we have been able to establish a small “rainy day fund.” While the current amount is enough to get us through an emergency, it is not anywhere close to the $1.6 million required for the needed renovations.

After considering many options, the board decided to move forward with a bond / millage proposal, settling on a 12-year term at a rate of 0.85 mils.

Want to know how this millage will affect your taxes? Check out this millage impact calculator.

We understand that costs are going up everywhere, pennies eventually add up to dollars, and every dollar matters. Since 2015, the library board has done what it can to maintain the building: cleaning the carpet (which is original), repairing cracked walls, and updating the restrooms. The board has also had a new HVAC system installed, the roof replaced, and an office created for the library’s Director. It is regrettable that previous boards were unable to set money aside for regular updates and improvements, since all funds allocated to them were needed for library operations. The current Board feels that after ten (10) years, now is the time to make more long-needed investments in the future of the library.

Ballot (August 2025)

On August 5, 2025, residents of Charleston Township and the City of Galesburg will be asked to approve a millage proposal allowing the library to issue tax bonds for an amount NOT TO EXCEED $1.6 million to renovate, equip and furnish the existing library facility. The millage to be levied to pay the proposed bonds is 0.85 mil ($0.85 per $1,000 of taxable value). This means that the average taxpayer will see an increase of no more than $50 - $80 annually ($1.00 - $1.50 per week, or $0.14 - $0.22 per day) for NO MORE THAN 12 years.

The official ballot can be viewed here.

Impact on Property Taxpayers

In addition to the architectural team, the library board is also working with a team of municipal financial advisors from PFM who have created a Property Tax Impact Calculator. By inputting information like their household income, their home's taxable value, and whether they qualify for Michigan's Homestead Property Tax Credit, taxpayers can determine the actual impact of the proposed millage. (See "Definitions" below.)

PLEASE NOTE: Neither the library nor PFM collect or record the information entered into the Impact Calculator.

PFM also provided the table below with estimates of both the annual cost and the "lifetime" cost of the proposed millage.

Definitions

- Taxable Value - The value on which property taxes are calculated. It can be found on your property tax statement or by contacting the Kalamazoo County Assessor.

- Assessed Value (SEV) - Assessed Value (or State Equalized Value) is defined by state law as 50% of the market value of the property as of December 31st of the preceding year.

- Homestead - A homestead is the primary dwelling of an individual, either owned or rented.

-

Homestead Property Tax Credit - A state program designed to reduce the property tax burden on homeowners, particularly those in lower or middle-income brackets, the elderly, individuals with disabilities, and veterans.

- Example: If a home is assessed at $200,000 and the exemption is $50,000, the property taxes would be calculated as if the home was worth $150,000.